how to avoid paying nanny tax

Alternatively you can ask your own employer to withhold more federal income tax from your wages to cover the extra nanny tax you will be covering. Although you may not think of yourself as an employer if a household worker such as a maid or gardener works for.

The Basics Of Household Payroll Nanny Taxes Tax Practice Advisor

If your nanny doesnt receive a W-2 by mid-February they can contact the IRS and.

. You must provide your nanny with a Form W-2 by the end of January each year so they. You should send 1040 estimated payments to the IRS four times per year. Your spouse Your child whos under age 21 A minor.

How can I avoid paying nanny taxes. Tips to avoid the Nanny Tax. You can do this either by withholding more.

Instead of paying your caregiver via company payroll and taking a business tax deduction you should pay them through your personal bank account. Complete year-end tax forms. I send my nanny her paystub by email each week with an overview of the hours she worked taxes withheld and gross and net income.

Pay your weekly maid no more than 2883 per house cleaning. Failure to pay the Nanny Tax has resulted in numerous high-profile scandals involving political appointees of every US. The IRS and the state you live in require you to.

Subtract Social Security and Medicare taxes income. This ongoing parade of Nannygate. Pay your every other week maids no more than 5765 per home cleaning.

It is very tempting to avoid these so-called nanny taxes but heres why you need to pay them and an overview of how its done. They want you to withhold taxes and treat them like an employee. The nanny tax threshold of 2000 for 2017 is increasing to 2100 in 2018.

One way for your client to reduce their tax liability if they have hired a nanny or home care provider is to use the Child care and services tax credit. In that case the nanny would need to complete a W-4 to allow the. But a better idea to avoid underpayment penalties or getting socked with a bigger-than-expected tax bill is to pay the IRS its due throughout the year.

Pay your weekly maid no more than 2883 per house cleaning. Add up the hours your babysitter worked. To avoid an end-of-year tax bill or penalties for not paying taxes as you earned your income you can ask your employer to withhold federal income tax from your paycheck.

Assuming your nanny is indeed an employee and not an independent contractor you dont have to pay a nanny tax if theyre. The parents do not have to withhold income tax from their nannys pay but may choose to do so if the nanny asks them to. You can do this by filling out.

You need to keep the two payrolls separate. Pay your every other week maids no more than 5765 per home. Tally your nannys hours multiply it by their hourly rate and add overtime pay to get the gross pre-tax amount you owe.

President from Clinton to Trump.

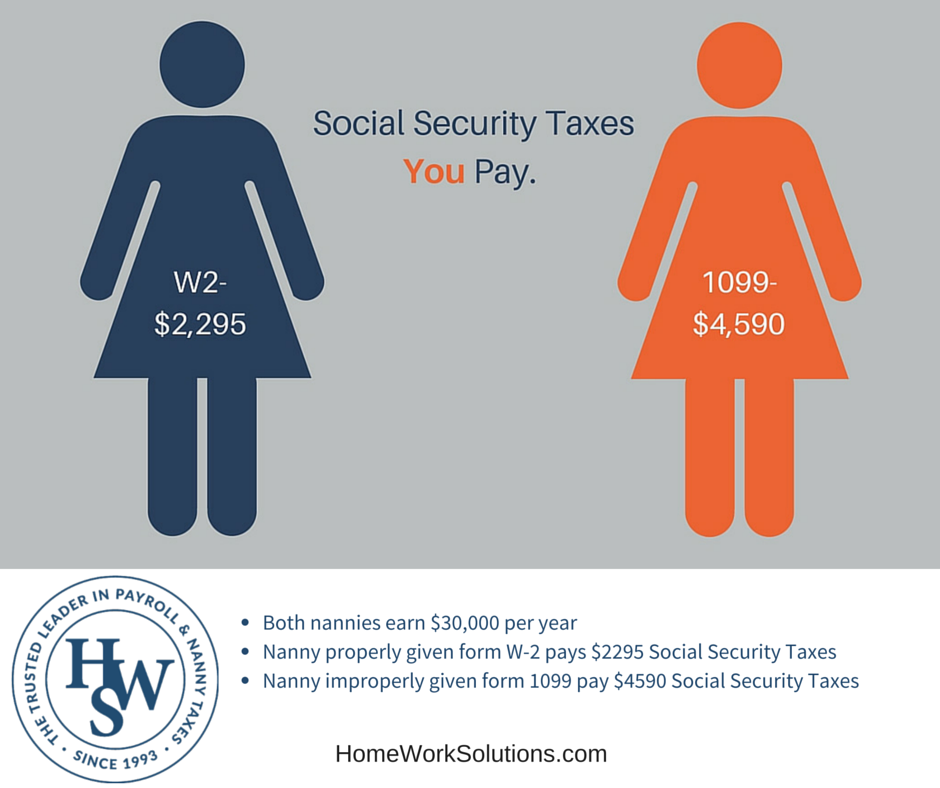

Nanny Given A 1099 Fights Back

3 Ways To Pay Nanny Taxes Wikihow

/Frame2167-cb5ec1e64a8f47e6a406dc0ee71ec3be.jpg)

Is It Ok To Pay My Nanny In Cash

How To Avoid The Nanny Tax Maid Service Faqs

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

How To Pay Nanny Taxes Yourself Care Com Homepay

Nanny Household Employment Tax Who Owes It Taxact

6 Household Employment Mistakes And How To Avoid Them Care Com Homepay

The Differences Between A Nanny And A Babysitter

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

How Do Nanny Taxes Work Date Night Boutique

Tax Reminders Archives Page 2 Of 2 Nannypay

3 Ways To Pay Nanny Taxes Wikihow

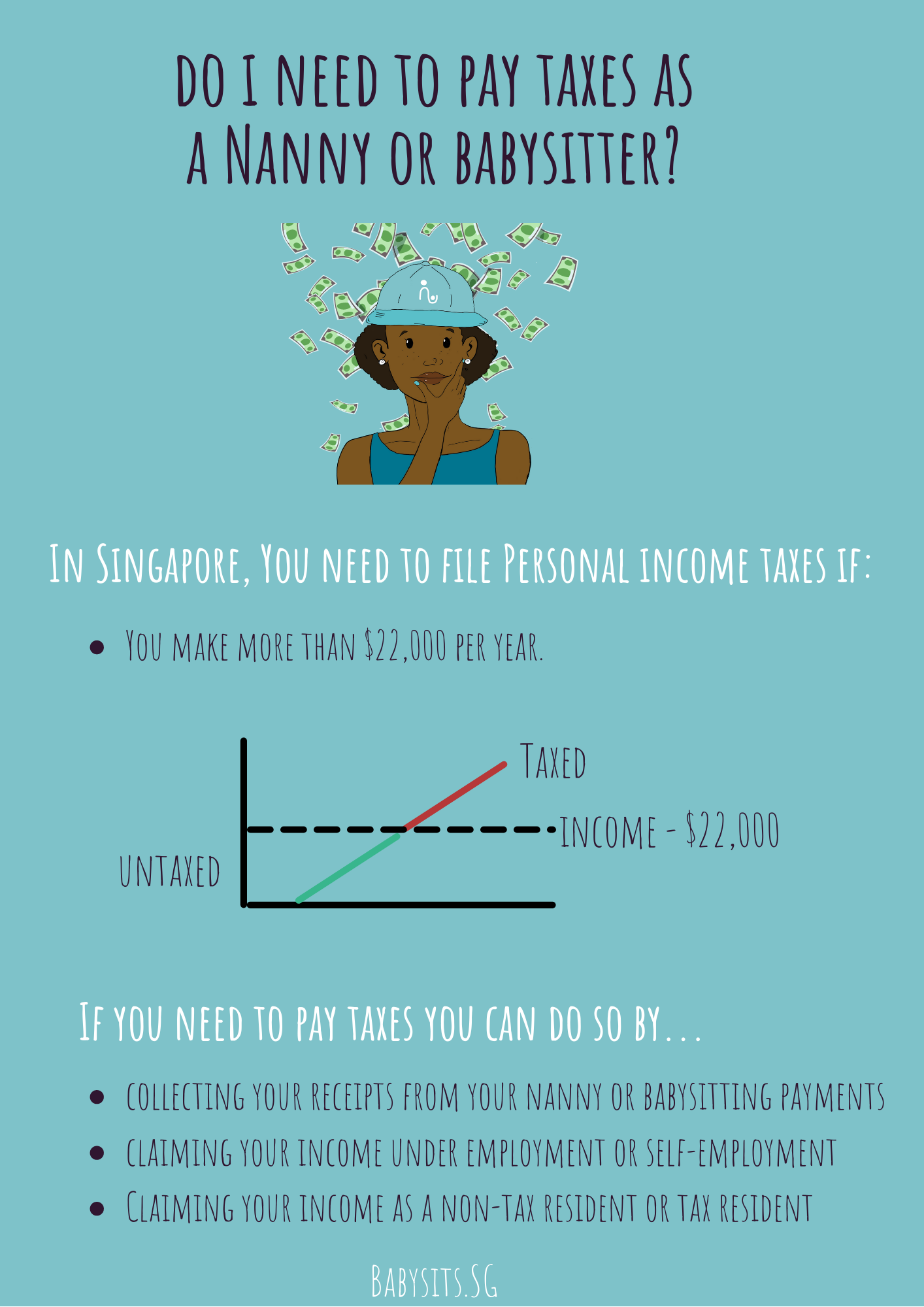

Nanny And Babysitting Tax In Singapore

The Abcs Of Household Payroll Nanny Taxes Cpa Practice Advisor